How to survive in a bear market? Tips for beginners

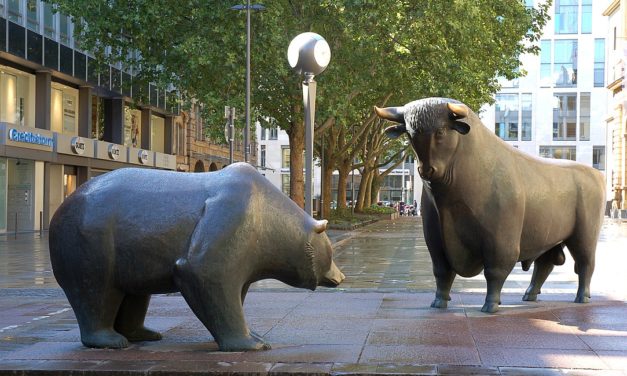

Usually, bear markets bring about a feeling of uncertainty in any investor. Even more so for a newcomer, for whom it can feel like the end of the world. It may even be common knowledge that during bull cycles, investors are sure of making gains. Whereas in bear markets such as this, an unimaginable amount of pessimism sets in.The co-founder and strategic lead at the Kylin Network, Dylan Dewdney, told Cointelegraph that the two major mistakes that investors make while feeling anxious are “One, over-investing and two, not investing with conviction.”“You need to find the sweetspot where you have enough conviction in your investments while managing the resources devoted to them such that you are 100% comfortable with being patient for a long time. Lastly, bear markets are where the magic really happens — buying Ether at $90 in December 2019, for example,” Dewdney said.According to data from blockchain analysis firm Glassnode, traders made almost 43,000 transactions buying and selling requests on crypto exchanges in early May. This accounted for a whopping $3.1 billion worth of Bitcoin. But, the panic that caused those requests came from the crash of Terra, which saw the market dip even further.Bear markets occur when there is a general dip in the prices of assets, of at least 20%, from their most recent highs. For example, the current bear market has Bitcoin (BTC) down by more than 55% from its November record high of $68,000. Bitcoin is now trading below the $25,000 mark at the time of writing.Bear markets: Genesis, severity and how long they lastBear markets are often tied to the global economy, according to Nerdwallet. That is, they occur either before or after the economy goes into recession. Where there is a bear market, there’s either an ongoing economic meltdown or an upcoming one.Essentially, a sustained price dip from recent highs is not the only indicator of an ongoing bear market. There are other economic indicators that investors must still factor in. This is to enable them to learn whether a bear market is playing out or not. Some of the indicators include interest rates, inflation and rate of employment or unemployment, among others.However, the relationship between the economy and a bear market is even simpler than that. When investors notice that an economy is shrinking, there are widespread expectations that corporate profits will soon start to reduce as well. And, this pessimism brings them to sell off their assets, thus, pushing the market even lower. As Scott Nations, author of The Anxious Investor: Mastering the Mental Game of Investing, says, investors often overreact to bad news.In any case, bear markets are shorter than bull markets. According to a recent CNBC report, bear markets last about 289 days. Bull markets, however, can go even above 991 days. Additionally, an Invesco data analysis report puts the losses attached to bear markets on an average of 33%. So, down cycles are usually not as effective as the average gain of 159% of a bull market.Recent: DeFi pulls the curtain on financial magic, says EU Blockchain Observatory expertAlthough no one knows for sure how exactly long a bear market might last, there are a few tips on how to weather it.Navigating a bear marketAs an investor, there is probably nothing anyone can do to prevent an unfavorable market condition or the economy at large. Nonetheless, there are lots of potentially great moves that one can make to protect their investments.Dollar-cost averagingDollar-cost averaging (DCA) describes an investment strategy in which an investor buys a fixed dollar amount of a certain asset on a regular basis, regardless of that asset’s price in dollars. The strategy is based on the belief that over time, prices will generally pick up the pace and eventually trend upward during a bull run.The head of research at CoinShares, James Butterfill, told Cointelegraph that Bitcoin now has a well-established inverse correlation to the United States dollar:The symbolic bear and the bull in front of the Frankfurt Stock Exchange. Source: Eva K.“This makes sense due to its emerging store of value characteristics, but it also makes it incredibly sensitive to interest rates. What has pushed Bitcoin into a ‘crypto winter’ over the last six months can by and large be explained as a direct result of increasingly hawkish rhetoric from the Fed. The Federal Open Markets Committee (FOMC) statements are a good indicator of this, and we can observe a clear connection to statement release times and price moves.”When this prudent investment approach is mastered, the investor’s buy price is averaged over time. That is, one can enjoy the benefits of buying the dip and also avoid investing all their life savings during market highs. After all, as dreaded as bear markets are in the investment world, they are also the best times to buy crypto assets at the lowest prices.Diversify your portfolioFor investors who have a diverse range of assets in their portfolio, the impact of bear markets may not be as severe. When bear markets are fully in progress, the prices of assets generally plunge but not necessarily by the same amounts. So, this valuable strategy ensures that an investor has a mix of winners and losers in their assets during a bear run. Thus, total losses from the portfolio will be reduced to the barest minimum.Consider defensive assetsDuring prolonged bear markets, some companies (mostly smaller or younger) tire out along the way. Whereas other more-established firms with stronger balance sheets can withstand the harsh conditions for as long as necessary.Therefore, anyone looking to invest in company stocks should go for stocks of those companies that have been in business for a long time. Those are defensive stocks. And, they are usually more stable and reliable in a bear market.BondsBonds can also offer an investor some relief during bear cycles. This is because the prices of bonds usually move opposite to stock prices. So, bonds are a key part of any near-perfect portfolio, giving an investor relative ease to the pain of a bear market.Index funds or exchange-traded fundsSome sectors are known to thrive reasonably well during market downturns, including the utilities and consumer goods sectors. And more than any other sector, they can perform to earn them the name “stabilizing assets.” Investing in the sectors mentioned above through index funds or exchange-traded funds (ETFs) can be a smart move. This is because each index fund or ETF holds shares across various companies.Play blindThere is no doubt whatsoever that a bear market will tempt investors to run and never look back. Their will and endurance will also be tested. But, as history has shown, bear markets don’t last forever and neither will the current one.According to Hartford Funds, more than 26 bear markets have occurred between 1928 and now. And, each one of those bear markets was immediately followed by a bull market, bringing more than enough profits to make up for whatever losses might have been incurred.So, it is important to always take your mind off the prevailing downturn, especially if you’re investing for the long term, like for retirement. Eventually, the bull markets you’ll witness along the way will outdo the bear markets.The ultimate decisionAs earlier explained, there are massive risks that come along with bear markets. But, they also offer a good basis for success in the next bull run. That is, however, dependent on good strategic investment planning mixed with patience. So, profits can be assured when the market finally turns around, whether you’re always DCA-ing, diversifying into other assets, investing in ETFs and index funds, or stocks.Losing money is always a hard pill to swallow, but the best way to get through market dips is not by running. Instead, take note of the wide array of recovery options and keep calm.Recent: Bitcoin and banking’s differing energy narratives are a matter of perspective“While Bitcoin’s price performance has been weak in the face of an aggressive Fed, this current hiatus in price-performance may very well be short-lived. We believe a policy mistake by the Fed is highly likely where Bitcoin prices are likely to diverge from growth equities. Meanwhile, the former is likely to benefit from a dovish Fed and weaker USD while the latter underperforming in the face of a recession or stagflation,” says Butterfill. He added: “Sadly, we believe that the U.S. and the rest of the world are likely to slip into economic decline in 2023, although there are many unknowns. Perhaps it will be stagflation that then progresses into recession? As the liquidity trap really takes a grip on central bankers, we believe Bitcoin is a good insurance policy in the face of this monetary policy mess.”

Čítaj viac