Disaster looms for Digital Currency Group thanks to regulators and whales

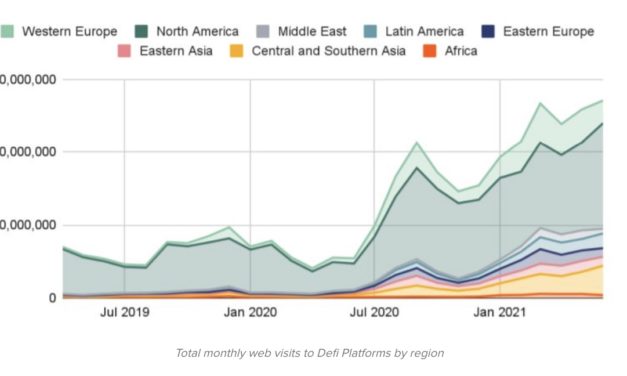

The cryptocurrency tide is flowing out, and it looks more and more like Digital Currency Group (DCG) has been skinny dipping. But let’s be clear: The current crypto contagion isn’t a failure of crypto as a technology or long-term investment. DCG’s problem is one of failure by regulators and gatekeepers.Since its 2013 inception, DCG’s Grayscale Bitcoin Trust (GBTC), the largest Bitcoin (BTC) trust in the world, has offered investors the ability to earn a high rate of interest — above 8% — simply by purchasing cryptocurrency and lending it to or depositing it with DCG. In many ways, the company performed a major service to the crypto industry: making investments into crypto understandable and lucrative for beginners and retail investors. And during the crypto market’s bull run, everything seemed fine, with users receiving market-leading interest payments.But when the market cycle changed, the problem at the other end of the investment funnel — the manner in which DCG leveraged user deposits — became more apparent. While not all questions have been answered, the general idea is that DCG entities loaned user deposits to third parties, such as Three Arrows Capital and FTX, and accepted unregistered cryptocurrencies as collateral. Related: My story of telling the SEC ‘I told you so’ on FTXThe dominos fell quickly thereafter. Third parties went defunct. The crypto used as collateral became illiquid. And DCG was forced to make capital calls in excess of a billion dollars — the same value of FTX’s FTT token that DCG accepted to back FTX’s loan.DCG is now seeking a credit facility to cover its debts, with the prospect of Chapter 11 bankruptcy looming if it fails. The venture capital firm apparently fell prey to one of the oldest investing pitfalls: leverage. It basically acted as a hedge fund without looking like it, loaning capital to companies without doing proper due diligence and accepting “hot” cryptocurrencies as collateral. Users have been left holding an empty bag.In the non-crypto world, regulations are set up to prevent this exact problem. While not perfect, regulations mandate entire portfolios of financial documents, legal statements and disclosures to make investments — from stock purchases and initial public offerings to crowdfunding. Some investments are either so technical or so risky that regulators have restricted them to investors who are registered. Um what did I miss? Didn’t we just say it was dimly $500m days ago? https://t.co/14FkXfiiyy— Adam Cochran (adamscochran.eth) (@adamscochran) November 25, 2022But not in crypto. Companies like Celsius and FTX maintained basically zero accounting standards, using spreadsheets and WhatsApp to (mis)manage their corporate finances and mislead investors. Citing “security concerns,” Grayscale has even declined to open their books. Crypto leaders issuing “everything is fine” or “trust us” tweets isn’t a system of accountability. Crypto needs to grow up.First, if custodial services want to accept deposits, pay an interest rate and make loans, they are acting as banks. Regulators should regulate these companies as banks, including issuing licenses, establishing capital requirements, mandating public financial audits and everything else that other financial institutions are required to do.Second, venture capital firms need to perform proper due diligence on companies and cryptocurrencies. Institutions and retail investors alike — and even journalists — turn to VCs as gatekeepers. They see investment flow as a sign of legitimacy. VCs have too much money and influence to fail to identify basic scams, con men and Ponzi schemes.Luckily, cryptocurrency was created to eliminate these very problems. Individuals didn’t trust Wall Street banks or the government to do right by them. Investors wanted to control their own finances. They wanted to eliminate expensive middlemen. They wanted direct, inexpensive, peer-to-peer lending and borrowing.That’s why, for the future of crypto, users should invest in DeFi products instead of centralized funds managed by others. These products give users control whereby they are able to maintain their funds locally. Not only does this eliminate bank runs, but it limits industry contagion threats.Related: FTX showed the value of using DeFi platforms instead of gatekeepersThe blockchain is an open, transparent and immutable technology. Instead of trusting talking heads, investors can see for themselves the liquidity of a company, what assets it has and how they are allocated. DeFi also removes human middlemen from the system. What’s more, if entities want to overleverage themselves, they can do so only under the strict rules of an automated smart contract. When a loan comes due, the contract automatically liquidates the user and prevents an entity from taking down an entire industry.Crypto critics will snipe that DCG’s possible implosion is another failure of an unsustainable industry. But they ignore the fact that the problems of the traditional financial sector — from poor due diligence to overleveraged investments — are the root causes of the challenges crypto faces today, not crypto itself. Some may also complain that DeFi is ultimately uncontrollable. But its open, transparent design is precisely why it is flexible enough to shake up the entire financial industry for the better.The tide may be flowing out, at least for now. But smart investments into decentralized finance today will mean we will be able to dive right back in when the next torrent comes — and this time, with a bathing suit.Giorgi Khazaradze is the CEO and co-founder of Aurox, a leading DeFi software development company. He attended Texas Tech for a degree in computer science.This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Čítaj viac