Does the IMF have a vendetta against cryptocurrencies?

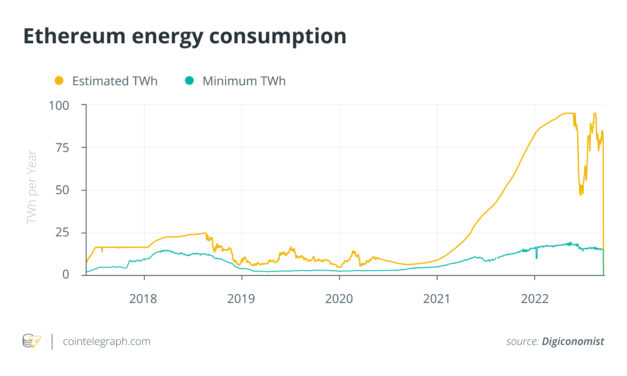

Is the International Monetary Fund (IMF) really hostile to crypto? Many in the cryptocurrency/blockchain space think so. In January, the fund asked El Salvador to drop Bitcoin (BTC) as legal tender. In May, it reportedly pressured Argentina to curtail crypto trading as the price for an IMF loan extension, and it also recently warned the Republic of the Marshall Islands (RMI) that raising a digital currency to the status of legal tender could “raise risks to macroeconomic and financial stability as well as financial integrity.”“I do believe that the IMF is an implacable foe of crypto,” David Tawil, president and co-founder at ProChain Capital, told Cointelegraph. Given that Bitcoin and other cryptocurrencies are ‘“issued” by non-state entities and are borderless, “crypto has the potential to be ubiquitous, which can significantly curtail the need for the IMF,” a financial agency of the United Nations.“Bitcoin stands against everything the IMF stands for,” Alex Gladstein, chief strategy officer of the Human Rights Foundation, told Politico in June. “It’s an outside money that’s beyond the control of these alphabet soup organizations,” while Kraken’s Dan Held simply tweeted, “The IMF is evil,” in response to the fund’s reported actions in Argentina.Still, others believe that this multilateral lending institution that serves some 190 countries — and has long been a lightning rod for criticism in the developing world — may have a more nuanced view of cryptocurrencies. A broad-minded view of crypto-assets?In a September report, “Regulating Crypto,” the IMF seemed to have no problem with the existence or even proliferation of non-governmental digital currencies. Indeed, it called for a “global regulatory framework” for cryptocurrencies in order to bring order to the markets “and provide a safe space for useful innovation to continue.” “The IMF has taken a very broad-minded view of crypto-assets,” John Kiff, managing director of the CBDC Think Tank and, until 2021, a senior financial sector expert at the IMF, told Cointelegraph, especially if one looks beyond some of the recent cases cited above. He added:“The Marshall Islands and El Salvador opinions pertained to country governments adopting crypto as legal tender when their unit of account currencies were already well established. And, those adverse opinions were mostly focused on the macroeconomic impact of hitching their fiscal wagons to cryptocurrencies.” Institutionally speaking, “it’s true that the IMF is skeptical of crypto, and it came down hard on El Salvador, Josh Lipsky, senior director of the Atlantic Council’s GeoEconomics Center, told Cointelegraph. But, that’s because the fund was worried about the financial vulnerability of that nation’s economy. The IMF “will have to bail them out” if and when El Salvador reneges on its international debt payments.Recent: Bitcoin miners rethink business strategies to survive long-termMeanwhile, “Argentina has done something like 20-plus lending programs over the years, so it can’t really go back to the IMF and renegotiate [its loans] while it is also conducting crypto experiments,” added Lipsky, who previously served as an adviser to the IMF and speechwriter to Christine Lagarde. The mayor of Buenos Aires, a cryptocurrency proponent, was reported to be developing plans that would allow the city’s residents to pay their municipal taxes in cryptocurrencies. “That raised some eyebrows” at the fund, commented Lipsky. Even Tawil agreed that the IMF was justified in forcing “certain policy choices, like austerity or taxation or removal of government subsidies that cannot be supported economically” under certain circumstances. If a country “has awful policies” that will make it persistently dependent on the fund’s support, then “the IMF will use its lending ability to influence policy choices.”Money laundering risks In connection with the Marshall Islands’ bid to implement a sovereign digital currency, or SOV, as a second legal tender, the IMF’s Yong Sarah Zhou cited not only financial stability perils but also “anti-money laundering and combatting the financing of terrorism (AML/CFT) risks.” Simon Lelieveldt, a Netherlands-based regulatory consultant for payments and blockchain, wasn’t really sure this was the fund’s main objection, however. Yes, crypto can be “used as an investment asset and also a tool for money laundering — as can cash in the bank,” but it is more likely crypto’s “ungoverned nature” that alarms the IMF and other intergovernmental organizations, including the Financial Action Task Force.Governments in the developing world sometimes feel “oppressed by IMF rulings and neoliberal dogmas” and are tempted to “escape the harness of the IMF” through the use of alternate legal tenders, actions that inevitably “lead to reactions from institutions that are afraid of losing their power,” he told Cointelegraph. A misbegotten case?El Salvador was the world’s first country to adopt Bitcoin, or any cryptocurrency, as legal tender in September 2021. “El Salvador was a really bad use case,” Lipsky told Cointelegraph. “What Terra Luna did for crypto in the United States, El Salvador did for crypto globally.” What went wrong? “There were so many failures, but if I were to pick one, it would be how rushed it felt.” There was a “paper-thin, two-page explanation how it [Bitcoin] would work,” and that was it. Rather than take an experimental approach, beginning with small pilots and independent risk assessments, the Bitcoin Law was hurried through El Salvador’s legislature and immediately imposed — “reckless and rushed,” according to one critic.The IMF’s wariness of crypto as legal tender only deepened in the wake of the El Salvador inept BTC launch, in Lipsky’s view.Still, institutions like the IMF and the World Bank arguably have an “outsized influence” on small countries looking to take more control over their currencies, and they “can apply pressure, from making aid conditional to simply blocking aid, unless countries comply with their requirements,” Henri Arslanian wrote in his recently published book, The Book of Crypto. Recent: What does the global energy crisis mean for crypto markets?When El Salvador recognized Bitcoin as legal tender, for instance, the World Bank, another lending institution in the United Nations system, not only criticized the move but “also refused to provide technical assistance, citing environmental and transparency concerns,” wrote Arslanian.Natural enemies?Given the mandate of nongovernment organizations like IMF and the World Bank — which is, broadly speaking, to support global financial stability and spur economic growth in the developing world — there could simply be a natural tension vis-a-vis decentralized currencies — which are often volatile and hard-to-control financial instruments with no return address or even identifiable individuals in charge. As Tawil noted, the IMF is often called upon to deal with economies “plagued by corrupt and inept leadership and illusory currencies” and, therefore, it really has “no incentive to add another ‘issuer-less’ currency.” Nevertheless, he added:“The IMF cannot ignore reality, which is that our future will be filled with cryptocurrencies.”

Čítaj viac